Background

Phu Hung Securities Joint Stock Company (PHS) is a foreign-invested securities company, renowned for its credibility in the Vietnamese market. Established in 2006, PHS offers a variety of high-quality financial services including securities brokerage, securities custody, financial support, investment advisory in securities, and corporate financial consulting. They also provide covered warrant services and bond-related services.

The main products like base securities and derivatives have been the primary sources of revenue for the company for many years.

Problem

Derivative securities contracts, mainly sold through brokers, typically have high values and generate significant profits. However, there is also a high risk associated with brokers who may leave at any time, resulting in the loss of long-term customers—often older individuals with stable incomes who usually delegate investment decisions to brokers.

Challenges and Opportunities

Older Customers:

‣ Often less interested in or resistant to changing technological habits.

‣ Require professional tools for investment analysis, which are challenging to integrate immediately on mobile.

‣ Focus on functionality and transparency.

Younger Customers:

‣ More interested in technology but face many options, creating high competition.

‣ Have limited investment knowledge and experience, and are risk-averse due to not having substantial financial resources.

‣ Demand a good user experience and modern interface.

The company is aiming to shift from a derivatives business model to focusing more on underlying securities, with the target customers being generation Z - young customers with the potential to become long-term customers. This requires a change in approach and tools, moving from a web platform to a mobile platform that is more modern and in line with trends. This poses a big challenge, requiring strong investment in new technology and marketing strategies.

Research

The goal is to find out specifically what problems users are having and then come up with appropriate design solutions. This is because the time spent on design is extremely short, plus the company's current application is quite primitive, does not have many users and does not have tracking systems to monitor user behavior indicators. So I use the User interview method to get the fastest and most accurate results.

Competitive analysis

After researching and researching, I found a list of domestic competitors that could be potential competitors for PHS. However, we also researched financial applications from abroad to see what they were doing. What points do you do well so that you can improve and add new features to our application?

Focus Group Interview

We employ the Focus Group Interview technique, structured into three distinct phases:

‣ Phase 1: Internal Client Interviews - We conduct interviews with our client's internal team to gain an understanding of their strategic vision, the challenges they face, and their expectations for the new application. This helps us align our development goals with their business needs.

‣ Phase 2: Professional Broker Interviews - We interview professional brokers to gather insights about their needs and the difficulties they encounter while using the application. Their expertise in the securities field provides us with a deeper understanding of the technical and practical aspects that the application must address.

‣ Phase 3: Potential Gen Z Customer Interviews - This phase involves interviewing potential Gen Z customers, both experienced and novice investors, to understand their investment capabilities, knowledge, concerns, and aspirations. These insights allow us to tailor solutions that cater to their specific investment journey.

Phase 1: Internal Interviews at PHS to Gain a Deeper Understanding of the Product

Interviewing directors and leaders from various departments at PHS:

‣ Interview subjects: Includes 3 team leaders from each team: Product, Marketing, and IT.

‣ Objective: To explore development challenges, technical issues, and strategic visions of the teams. We investigate the essential features they consider necessary for customers, identify limitations of the MVP version and advanced features for subsequent versions. Additionally, we discuss product launch plans and available APIs.

Individual meetings with each team: Following the interviews, we organize separate meetings with each team to gather detailed feedback and allow them more time to share their opinions.

Marketing Team:

‣ Participants: 3 members of the PHS Marketing team.

‣ Objective: To understand the communication and marketing needs of the product to customers. With their deep understanding of the target audience, this interview helps us recognize important factors from the perspective of marketing professionals.

Customer Service Team:

‣ Participants: 3 members from the customer service team.

‣ Objective: To gather information from those who directly interact with customers. Their feedback on customer experiences and emotions when using the product is invaluable, helping us understand positive and negative user interactions.

IT Team:

‣ Participants: 3 members from the IT team.

‣ Objective: Learn about difficult problems related to technology. Find the reason for errors related to instability and slowness of the old system so the development team can provide solutions.

Results:

1. Application Fragmentation: The current application is scattered across various platforms, making it difficult to manage and provide a unified user experience.

2. Lack of Simplification and Customization: The application needs to be simplified to suit users unfamiliar with stocks, while also providing advanced features for professional investors.

3. User Conversion: Converting users from current applications to the new app needs to achieve at least 60-70% to ensure no loss of customers.

4. Registration Process and eKYC: The current process is slow and complex, involving multiple steps and frequent technical issues like sending OTPs and face scanning.

5. Tracking and Analytics: There is a lack of capability to track and analyze current users, making it difficult to accurately assess the effectiveness of marketing campaigns and brokerage activities.

6. Integration and Security: There is a need to improve app integration features, such as smart OTP, to prevent security risks and provide a smoother user experience.

7. Competitive Advantage and Collaboration: The current application does not reflect PHS's competitive advantage in derivatives and needs to be further leveraged within the Phu Hung ecosystem.

8. Legal Requirements and Compliance: The application must ensure compliance with legal requirements and secure customer information.

Phase 2: Broker Interviews

1. Broker Director Interview:

‣ Participants: Three brokerage directors.

‣ Objective: To understand the professional users' perspective on the current app, their expectations for the new app, how they evaluate other investment apps on the market, and their favorite or least liked features. We also explore their overall perspective on the market and how they organize the work of brokers.

2. In-depth Interviews with Other Brokers:

‣ Participants: Base and derivative brokers, three from each group.

‣ Purpose: To discuss the challenges of using the current mobile app and delve deeper into their daily workflows. We want to understand more about the features and user experiences they expect from our new app, as well as how they compare our app to others on the market.

Results

1. Interface and Navigability: Brokers find the app's interface difficult to use, with unclear icons and functions leading to confusion and difficulty in conducting transactions.

2. Order Placement Function: Placing orders is inconvenient, lacking clear buying and selling features and detailed stock information, making portfolio management challenging.

3. Performance and Latency: Issues with loading speed and data update delays affect trading decisions, especially in a fast-trading environment.

4. OTP Features and Security: OTP complicates user experience, especially for older individuals and in situations requiring urgent transactions, with too short an OTP validity period.

Phase 3: Interviews with Young Gen Z Investors

1. Internal PHS Gen Z Users:

‣ Participants: Three PHS employees aged 20-30, experienced with the current app and have invested through other apps.

‣ Objective: To gather opinions on the strengths and weaknesses of the current app, features they believe are necessary for users of similar age, and comparison with other competitive apps.

2. External Experienced Gen Z Investors:

‣ Participants: Three individuals referred through the customer support team, aged 23 to 27.

‣ Objective: To gain deeper insights into their investment experiences, important and unimportant features to them, and analyze their investment perspectives (short-term or long-term).

3. Gen Z Users Without Investment Experience:

‣ Participants: Three individuals referred through internal connections, aged 23 to 27.

‣ Objective: To explore barriers, concerns, and lack of knowledge about stock investments, understand why they have not used investment apps, and how they approach new apps.

Results

1. User Interface and Experience (UI/UX):

‣ Customizability and intuitiveness: Gen Z users prefer apps with intuitive interfaces, easy customization, and seamless linkage to bank accounts.

‣ Difficulty in finding and using features: Some users struggle to find the withdrawal feature or other features in the app due to unclear design.

2. Order Placement Function:

‣ Order placement experience: Users want the order placement process to be quick and efficient. They typically have specific stock codes in mind when they open the app and do not want to waste time with complex procedures.

3. Features and Tools:

‣ Information and investment recommendations feature: Need to provide more comprehensive and useful information in the app to attract Gen Z users, including investment recommendations and related promotional offers.

4. Market Information:

‣ Tracking and updating information: Gen Z users prefer to follow and update market information on other stock apps besides PHS because other apps provide more comprehensive and user-friendly information.

5. Security and Financial Management:

‣ Safety and security: Especially important for Gen Z users, they prioritize using apps with good security features to ensure the safety of their personal and financial information.

6. App Appeal:

‣ User-friendly interface and easy-to-access features: Apps that allow customization of the interface to personal preferences and provide a positive user experience will attract more Gen Z users.

Research Results

Phase 1: Internal Interviews

1. Application Fragmentation: Difficult to manage and provide a unified user experience as the current application is scattered across multiple platforms.

2. Simplification and Customization: Lacks simplification for new users and advanced features for professional investors.

3. Registration and eKYC Processes: The registration process is slow, complex, and often experiences technical issues like sending OTPs and face scanning.

Phase 2: Broker Interviews

1. Interface and Navigability: The interface is difficult to use, with unclear icons and functions.

2. Order Placement Function: Placing orders is inconvenient, lacking detailed stock information, making portfolio management challenging.

3. Performance and Latency: Issues with loading speed and data update delays affect trading decisions.

4. OTP Features and Security: OTP complicates user experience, especially for older individuals and in urgent transaction situations.

Phase 3: Interviews with Gen Z Users

1. User Interface and Experience (UI/UX): Gen Z users prefer apps with intuitive interfaces that are easy to customize.

2. Order Placement Function: Users want the order placement process to be quick and efficient.

3. Features and Tools: Gen Z users desire comprehensive and useful information and investment recommendation features.

Prepare for Design

After gathering the findings from our research, we coordinated with the product and development teams to plan the product development. We identified features that align with customer needs and desires, while also balancing the development timeline to create a comprehensive MVP version that meets the needs of various user types and is timely for launch.

Branding & UI Kit

Before proceeding with the interface design, we thoroughly studied the brand identity provided by the client. With the requirement that the application must support both light and dark modes, I selected colors that ensure good visibility on both backgrounds. We also chose a design style, graphic components, and font types that suit our target audience, while ensuring the application is easy to use and practical. Three options were developed and presented to the client to gather feedback and make timely adjustments.

App Structure

During the development of the app's structure, I divided the application into 5 pages, corresponding to the 5 main workflows that users will interact with. Each page is designed to be simple, allowing new users to easily use it without being overwhelmed by too much information, yet still providing all the necessary features that a professional user would need.

User Flow

We consolidated the main features with the team and sketched a general application usage flow to ensure everyone understands how the application operates and how users interact with it. Detailed user flows were developed for processes such as login, eKYC, registration, searching, trading, order books, etc.

Design Process

Welcome, Login & Forgot password

The login process of the app is very simple. When users download and open the app, the splash screen appears and disappears after 5 seconds. Users then select a language, and a welcome screen appears, introducing the app's key features. Users can choose to skip or continue to the next slide. If users have previously registered, they are prompted to enter their account number and password. If they have logged in before, only the password input screen appears. Users can also choose to log in using biometrics if previously set up. If it is their first time using the app, a notification will ask if they want to activate biometric security. If users forget their password, they can click on the "Forgot Password" link and provide the necessary information. After validating their phone number with an OTP code, they can set a new password and log back in.

Register & eKYC Verification flow

During the login process, if users do not have an account, the app redirects them to the registration process. Here, they simply need to complete 5 straightforward steps. These steps include entering personal information as required for business operations, especially if they are business customers or foreigners, they must fill out a form for support. The registration steps involve identity verification by taking a photo of a national ID card, biometric facial comparison, and uploading a signature. Once verified, users can choose additional services and provide company information if applicable. Next, they create a password according to set criteria and verify their phone number via OTP. A success notification screen then appears, and users can begin logging in.

Although this process is more complex than other apps, it ensures users fully meet the company's business and security requirements.

The process of retrieving your PIN is as simple as retrieving your password

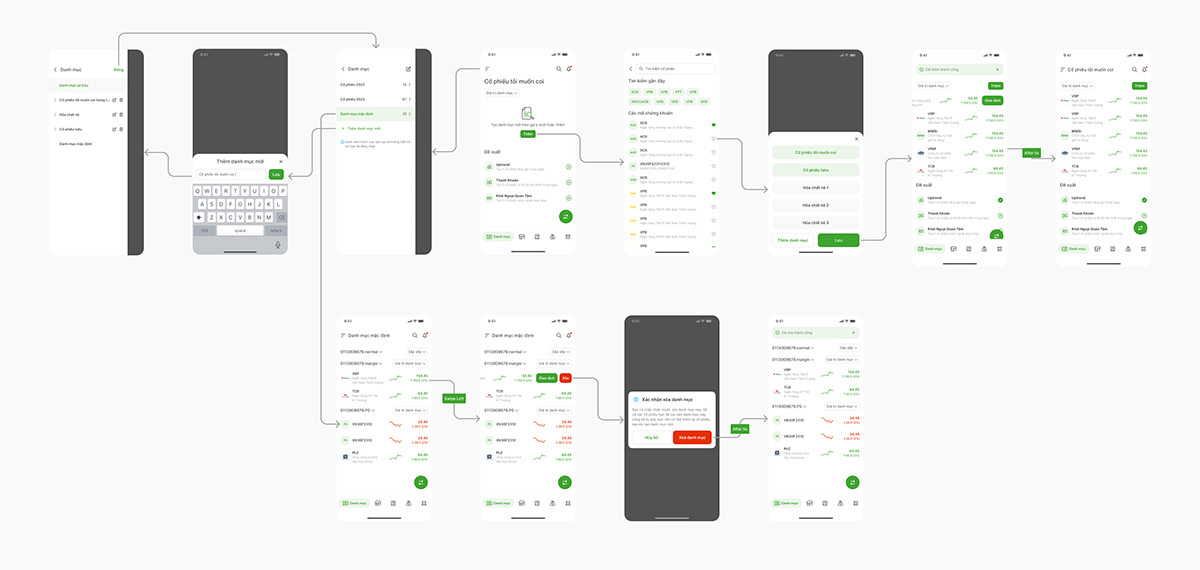

Watchlist

After logging in, users see the watchlist screen. If it's a new user without any stocks added, the screen will be empty. They can add stocks by pressing the "Add" button in the middle of the screen or the "Search" button at the top. A recommended list of stocks appears under the search bar, updating as the user types. After selecting a stock, they press the heart icon to save it to the watchlist and choose the list they want to add it to. A toast message will appear to confirm that the stock has been successfully added. In the watchlist screen, users can swipe right on a specific stock to delete it, and a successful deletion screen will display. Users can also initiate transactions by pressing the "Trade" button. To view other stock lists they have created, they press the three-line menu icon on the left side of the screen. Here, they can edit the name, add a new list, or reorder the list by pressing the "Edit" button, and once finished, they press "Done" to save the changes.

Purchase Flow

To start trading, users can select a stock code from either the Watchlist or Market View screen. On the Market View screen, recommended stocks are tailored to users' needs and display market information such as trading volume, price fluctuations, and top trading activities. Selecting a stock takes users to a detailed page with a price chart, ceiling/floor prices, trading volume, financial indicators, and related news.

The Order Placement screen is designed to be informative yet straightforward to avoid overwhelming users. They can select their account, check purchasing power, choose the order type, and enter the desired price and quantity. Users can also change the stock code or view ceiling and floor prices. After filling in all the details, they simply confirm the information and enter an OTP to complete the transaction. A success notification will appear, and users can either continue trading or exit to do other tasks.

This trading screen design is very effective, with information logically arranged, helping users easily follow and not miss any steps. This not only facilitates quick transactions but also saves time and promotes app transactions.

Asset management

The asset management page displays charts that show the distribution of funds across different types of accounts. You can view detailed values of assets, broken down by account type. On the same page, you can also see the profit and loss status of each investment item in the portfolio.

Summary

The development process encountered numerous obstacles due to working with multiple API providers and internal technical limitations at PHS, leading to project delays and unexpected issues. For example, we received feedback that was irrelevant to the original development scope or requests for features outside the MVP. Although I could no longer continue with the project due to my contract expiring and budget constraints, I am pleased to have contributed to the development of a promising application for the future.